So what is Medicare Part C all about? Medicare Part C is also known as Medicare Advantage. If you're confused about the differences between the various types of Medicare, you're not alone. This guide will explain Medicare Part C in detail so you understand its benefits and how they apply to your own health care.

Who Provides Medicare Part C?

While Medicare Parts A and B are provided by the federal government, Medicare Part C is not. It's separate health coverage offered by private health insurance companies that actually replaces Original Medicare. The types of Medicare coverage include:

- Part A: Hospital insurance

- Part B: Medical insurance

- Part C (aka Medicare Advantage): health coverage offered by private health insurance companies

- Part D: Prescription drug coverage

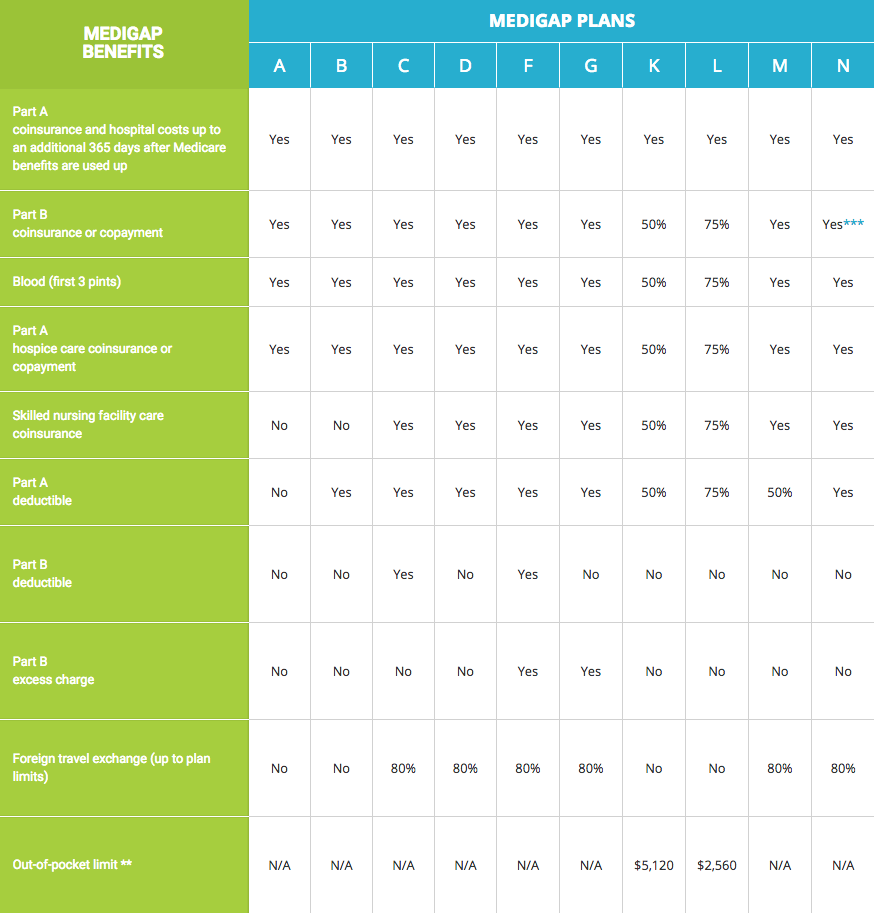

- Supplemental Medicare (aka MedSup or Medigap): comprehensive secondary health coverage offered by private health insurance companies that is a supplement to Original Medicare coverage.

What You Should Know About Medicare Part C Coverage

Because Medicare Part C is administered by private insurance companies, it can be somewhat confusing to differentiate from Original Medicare. Here are some important things you should know about Medicare Advantage:

- Medicare Part C is considered an alternative to Original Medicare.

- All Medicare Part C plans are required to offer the same coverage as Medicare Part A and Part B, except hospice care .

- Some Medicare Part C providers also offer additional coverages. These may include some dental, vision, hearing or prescription drug benefits .

- You are not allowed to enroll for both Medicare Part C and a Supplemental Medicare policy at the same time.

- Medicare Part C requires enrollment in Medicare Part A and Medicare Part B.

- There are different types of Medicare Part C plans, just as there are different types of private health insurance plans.

- Medicare Part C requires a monthly premium that is separate from the Medicare Part B premium. You will pay both premiums (though your Medicare Advantage provider may pay a portion of the Medicare Part B premium for you). Medicare also pays the private insurance company a set amount each month for your Medicare Advantage costs.

- Each Medicare Advantage plan may also require copays, coinsurance and an annual deductible. The policies and amounts vary among providers.

- Your Medicare Advantage plan may also have its own requirements regarding specialist referrals, in-network vs. out-of-network costs, etc.

What Is Covered by Medicare Part C?

Medicare Part C (Advantage) is required by law to include all the same coverages as Original Medicare. However, the extra coverages may vary. Compare several different Medicare Part C plans to find one that best suits your healthcare and financial needs. For example, if you wear glasses, choose a Medicare Advantage plan that covers routine vision screenings.

Types of Medicare Advantage Plans

There are different types of Medicare Advantage plans. They are typically:

Preferred Provider Organizations (PPOs)

- These have discounted costs when patients see health care providers within a network; out-of-network visits are usually more expensive.

- Referrals are not required for specialist services.

Health Maintenance Organizations (HMOs)

- These usually require patients to see health care providers within a small network. Services rendered outside the network will typically incur out-of-network charges.

- Referrals are usually required for specialist services.

Private Fee-for-Service (PFFS)

- These pay a set amount for each service a health care provider performs.

- Patients are usually required to pay the remaining portion of the provider's fee.

Medical Savings Account (MSA)

- These are similar to Health Savings Accounts (HSAs).

- Tax-deferred money is placed into an account. You can use these funds to pay for services until the plan's deductible is reached.

Special Needs Plans (SNPs)

- These provide coverage for patients with specific diseases.

- Benefits are customized for patients' needs.

- Drug coverage is included.

- Patients usually must see health care providers within the SNP's network.

Medicare Part C Enrollment Information

To enroll in any Medicare Advantage plan, you'll need to meet a few criteria:

- You live within the plan's service area as listed under the details of the plan. If you've moved within the past year, contact the plan administrator to determine your eligibility.

- You currently have Original Medicare (Parts A and B).

- You do not have End Stage Renal Disease (ESRD).

If you meet all of these criteria, you can enroll in a Medicare Advantage plan, but you should research your options thoroughly first.

Medicare Advantage Enrollment Periods

Remember that you must enroll, disenroll or switch Medicare Part C plans during eligible enrollment periods. These are:

- During your initial coverage election period with Original Medicare. This usually starts three months before your 65th birthday and ends three months after your 65th birthday. For example, if your birthday is in August of 2017, you can enroll from May 1, 2017 through November 30, 2017.

- From October 15 to December 7 of each year. This is known as the Annual Election Period

- You may disenroll from Medicare Advantage from January 1 to February 14 of each year. If you disenroll, you will be returned to Original Medicare.

- During a Special Election Period. You must qualify by meeting one of these criteria:

- Moving out of your plan's service area

- Having full Medicaid coverage and Medicare

- Living in a nursing home, nursing facility or rehab hospital.

- Qualify for the low-income subsidy program.

Medicare is one way to ensure you have access to the health coverage you need. Learning the details about how Medicare Part C works can help you to decide when to enroll and what options to choose.