Medicare plans are complicated, there's no doubt about it.

With all the information floating around and all the different plans, it can be hard to find out what you need to know about a plan, and information can get lost in translation.

However, worry not, because we've done the necessary research and gathered all the information you need to know about Medigap Plan N, and put it into one helpful, easy-to-read article.

And yes, it was as fun as it sounds.

So, without further adieu, let's get started with everything you need to know about Medicare Part N!

What Is Medigap?

Most of us have heard of Medicare, however, Medigap is a much less commonly known term.

Medigap refers to extra insurance you stack on top of your regular insurance plan, and it's also often called supplemental insurance.

However, it's not necessarily that simple.

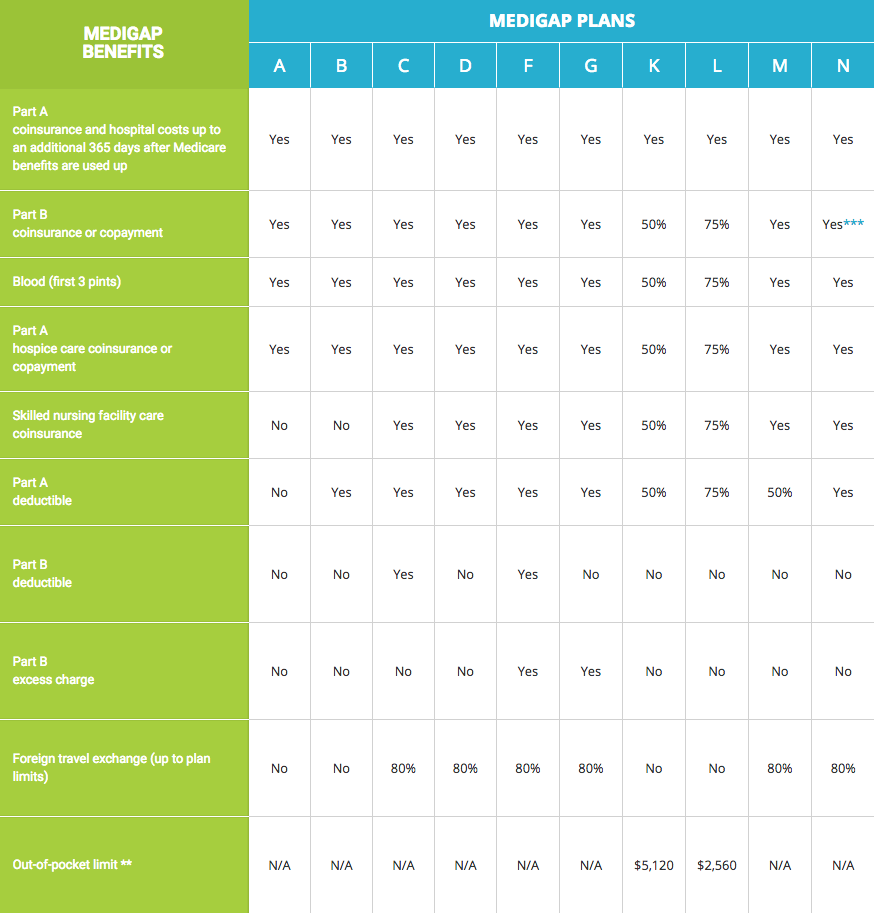

There are actually a whopping 10 Medigap plans offered for fine citizens such as yourself, and each one covers different things.

What most people don't know is that normal Medicare plans will just cover the basics, and these Medigap plans will fill the "gaps" in your coverage.

Clever, right?

What Does Part N Cover, Specifically?

As we said, each of the 10 Medigap plans available covers different things and to different extents.

But what does Part N cover, and how much does it do?

Well, luckily for you, it's actually quite a lot.

Medigap Plan N is very comprehensive, and covers a lot of the extra expenses your normal Part A or B plan won't cover.

Here are some examples:

Part N covers your entire Part A coinsurance and hospital costs for up to an entire year after your benefits are used up, which is a great deal.

Part N also covers Part B coinsurance or copayment, but has some specific exceptions and will sometimes require a $20-$50 copay on a case-to-case basis.

Besides that, Part N also covers skilled nursing care, hospice care and your first three pints of blood, none of which are covered by your base Medicare plan.

And, last but not least, Part N covers your entire Part A deductible and 80 percent of all your foreign travel health care, which, once again, is not covered by your base Part A or Part B plans.

Whew, that was a lot of info, but we've still got more to get through, so let's buckle up and keep going!

Are You Eligible for Coverage?

Ah, the big question.

Well, as with all Medicare and Medigap plans, Part N has a specific cutoff, and you must be at least 65 years or older to enroll.

However, there's a bonus for those of you who are about to turn 65 or have recently hit the big number.

What is it, you ask?

Well, Medigap Part N actually has an open enrollment period during which you cannot be declined coverage.

The open enrollment period starts the day of your 65th birthday and lasts an entire six months, guaranteeing your coverage despite pre-existing conditions.

But what if you aren't in your open enrollment period?

Well, things can get tricky then.

You're still allowed to apply for coverage when you like, but an insurance company isn't required to accept you, and your premium can be raised if you aren't in the open enrollment period.

So, your best option is to go for the open enrollment period, but you can still apply later if you like what the plan has to offer.

Who Provides This Plan?

The Medicare program is a federal program overseen by the Department of Health and Human Services.

Sounds exciting, right?

Well, despite the fact that the government is the one providing this plan and all other Medicare plans, you still have to go through a licensed insurance provider to actually receive coverage.

Finding the right provider for you can be a daunting task, but organizations like Get Medicare Solutions can help guide you through the process and find the right insurance provider that fits your individual needs.

How Do You Enroll?

Once you've gone through the process of selecting the right provider, enrollment should be a relatively easy task.

Now that we've figured out whether or not you're eligible for application or open enrollment, you just need to talk to your insurance agent and ask what plans they offer and what the premium will cost you.

Which actually brings us into our next section:

Do You Need This Plan?

The last big question, and what a journey this has been.

So, do you need Medigap Plan N?

The short answer is maybe.

Now that you know what the plan covers, you should ask yourself how often you're using the services covered by the plan.

Do you use skilled nursing or hospice care? Do you visit hospitals or clinics often?

If the answers to those questions is "yes," then this plan is likely a good option for you.

And if you're still not convinced then you can always click here and get a free consultation to find out exactly how much your plan will cost you.

Conclusion

That was a lot of information to get through, but we're finally here!

That was everything you need to know about Medigap Plan N, collected all in one place.

Thanks for reading! We hope you enjoyed the article, and now that you're armed with this new information and help you can decide whether Medigap Plan N is right for you!

While plan N isn't the right fit for everyone, it may be right for you. Again, we advise taking advantage of a free consultation to see if its the right plan for you.