Medicare Supplement plans

All Medicare Supplement (Medigap) plans are regulated by state and federal laws to protect you. They are identified in most states by letters. All policies provide the same basic benefits, however, some provide additional benefits. In Massachusetts, Minnesota, and Wisconsin, plans are standardized differently.

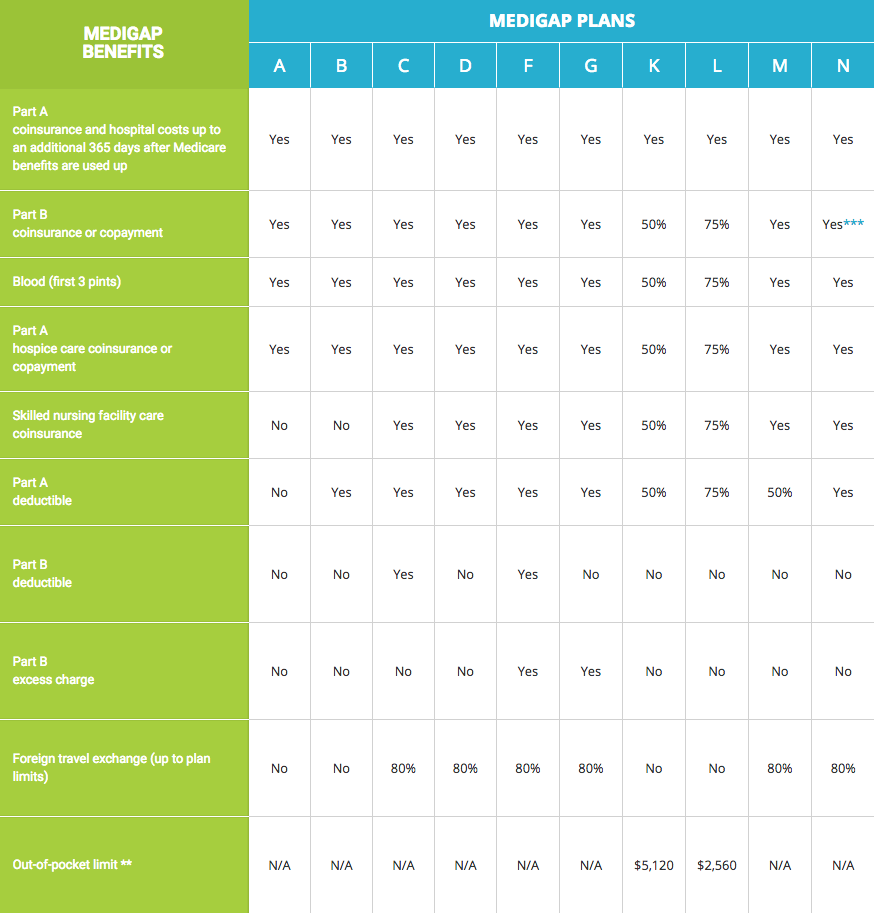

Medicare Supplement Plans Comparison Chart

| Medigap benefits | Medigap Plans | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| a | b | c | d | f | g | k | l | m | n | |

| Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up |

Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Part B coinsurance or copayment |

Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes*** |

| Blood (first 3 pints) | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Part A hospice care coinsurance or copayment |

Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Skilled nursing facility care coinsurance | No | No | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Part A deductible |

No | Yes | Yes | Yes | Yes | Yes | 50% | 75% | 50% | Yes |

| Part B deductible |

No | No | Yes | No | Yes | No | No | No | No | No |

| Part B excess charge |

No | No | No | No | Yes | Yes | No | No | No | No |

| Foreign travel exchange (up to plan limits) | No | No | 80% | 80% | 80% | 80% | No | No | 80% | 80% |

| Out-of-pocket limit ** | N/A | N/A | N/A | N/A | N/A | N/A | $5,120 | $2,560 | N/A | N/A |

Yes = the plan covers 100% of this benefit

No = the policy doesn't cover that benefit

% = the plan covers that percentage of this benefit

N/A = not applicable

* Plan F also offers a high-deductible plan. If you choose this option, this means you must pay for Medicare-covered costs up to the deductible amount of $2,200 in 2017 before your Medigap plan pays anything.

**After you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in inpatient admission.

Special Notes:

-

Plan C & F - These are being phased out and will no longer be sold after 2020. If you have plan C or F currently, you are grandfathered in and will not lose coverage unless you dont pay your premiums, however, the pool of healthy beneficiaries in these plans will no longer increase, which will likely lead to larger increases in premiums. We advise you talk to an agent about your options immediately.

-

Plan G - Practically identical to plan F, however you pay the Part B deductible. Premiums are usually lower and this is the most popular supplement plan on the market today.

-

Plan N : Doesn’t cover excess charges, there is a $20 copay and $50 for ER, however, premiums are lower than plan G and is a popular option for folks who are okay with some out-of-pocket expenses in lieu of higher premiums.